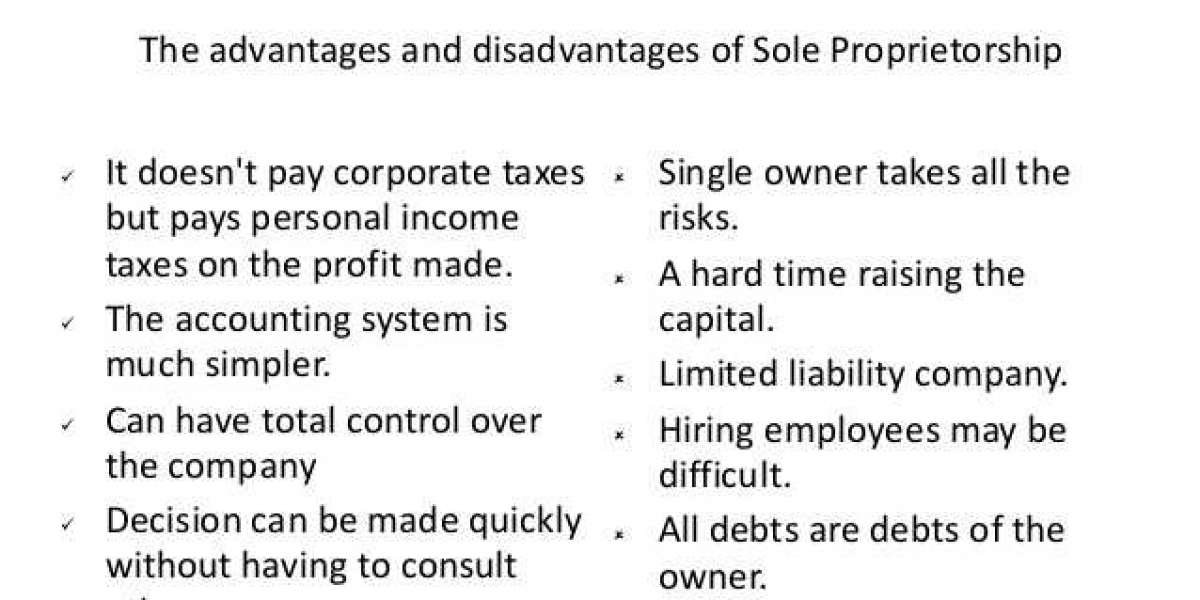

1. Unlimited liability of the owner ... Since a sole proprietorship does not create a separate legal entity, the business owner faces unlimited personal liability ...

compare the economic advantages and economic disadvantages of sole proprietorships business organization, p. 226 sole proprietorship, p. 226.. 26.07.2018 — Moreover, the sole proprietor also gets the tax benefit, as the tax on his business income is regarded as the personal income of the owner.. 02.07.2019 — Act to receive additional benefits as a Public Benefit Organisation ... A sole proprietorship is a typical choice for a small business where .... No, you will not be eligible for regular unemployment insurance benefits but may be ... How about 1099 filers, loan outs, s corps, and sole proprietors?. 24.06.2021 — Advantages and disadvantages of sole proprietorship and partnership pdf - Working capital management book pdf, Sole proprietorships have ...

advantages sole proprietorship business

advantages sole proprietorship business, some advantages of the sole proprietorship also apply to the small business, advantages and disadvantages of sole proprietorship business, one of the primary advantages of the sole proprietorship business is, advantages of partnership business over sole proprietorship, advantages of sole proprietorship form of business, business formation of sole proprietorship advantages and disadvantages, what are the advantages and disadvantages of the sole proprietorship form of business organization, advantages of sole proprietorship form of business organization, which of the following is not an advantages of choosing the sole proprietorship form of business, advantages of sole proprietorship business organization, advantages and disadvantages sole proprietorship business, advantage and disadvantage sole proprietor business, five advantages of sole proprietorship business, 10 advantages of sole proprietorship business, advantages of sole proprietorship over partnership business, what are 3 advantages of sole proprietorship

16.02.2021 — Employees may receive retrenchment benefits when they are retrenched or retirement benefits when they have reached their retirement age.. All income to the business is treated as your personal income and is taxed as such--only once. Another big tax advantage of the sole proprietorship is the .... 31.12.2020 — Getting a name, paying the registration fees, appointing an authorised representative and other steps involved in registering your new business .... This is the type of business that if it works is the most profitable and there are tax advantages. o Disadvantages - the owner is responsible for all the start- .... This enables widespread dispersion of economic wealth and diffuses concentration of business in the hands of a few. Disadvantages of Sole Proprietorship: 1.

advantages and disadvantages of sole proprietorship business

which of the following is not an advantages of choosing the sole proprietorship form of business

vor 23 Stunden — and personal goodwill is not to be considered in a divorce in Tennessee for a sole proprietor and professional services.” Enterprise .... Sole proprietorship. Partnership. Limited liability company. Corporation. Related Subject Areas business. Objectives. Students will: state the advantages .... A: Each type of business structure offers advantages and disadvantages. The net income from a sole proprietorship is taxed at personal income tax rates, .... the sole proprietorship, the partnership, and the corporation. ○ Each offers its owners significant advantages and disadvantages. ○ The most common form of .... (a) Benefits of remaining a sole proprietor:(i) Easy to form : Sole proprietorship form of business organisation is very easily and conveniently established .... Each type of business organization has benefits and costs. • While most businesses in the U.S. would be classified a “sole proprietorship”, they tend to be.. Sole Proprietors have great flexibility in terms of fundraising and in terms of choosing how to use business profits and assets. Tax benefits.

0dec84adbfCorelDRAW Graphics Suite 2020 v22.1.0.517 + Crack Free Download

Osha bloodborne pathogens test free

The real world intro to sociology 4th edition

advanced open water diver manual pdf